Consequently, a taxpayer could have substantial business expenses and still claim the standard deduction," Eric Bronnenkant, CPA/CFP and Head of Tax at online financial advisor Betterment, told CNET in an email. "Business expenses are known as above the line deductions which are available regardless of the choice to itemize. If you're self-employed or own a business, you can deduct business expenses on your taxes regardless of whether you take the standard deduction or itemize.

The IRS encourages taxpayers to itemize when your "allowable itemized deductions are greater than the standard deduction or you can't use the standard deduction." Self-employed and business owners can deduct work expenses even if they take the standard deduction It is a simpler route than itemizing your deductions, which requires further proof of expenses and receipts. Most Americans choose the standard deduction when filing their taxes. Your decision will depend on whether the total of your itemized deductions is greater than the standard deduction - $12,950 for single filers, $19,400 for head-of-household filers and $25,900 for married people filing a joint return.Īlong with eligible work expenses, personal itemized deductions can include mortgage interest, retirement contributions, property taxes, charitable donations, medical expenses and student loan interest. If you are an eligible W-2 employee, you can only deduct work expenses on your taxes if you decide to itemize your deductions. Eligible W-2 employees need to itemize to deduct work expenses Each eligible teacher can deduct up to $300 of unreimbursed expenses on line 11 of Form 1040 Schedule 1.

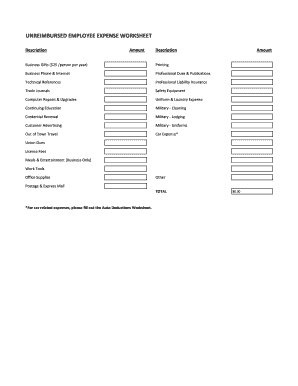

UNREIMBURSED EMPLOYEE EXPENSES DEDUCTION PROFESSIONAL

Receipts must be provided for all lodging expenses or for any work expense of $75 or greater.Įligible educators working in kindergarten through 12th grade can also deduct some of their work expenses, including professional development and classroom supplies. Those eligible taxpayers can report and claim their unreimbursed work expenses using Form 2106, "Employee Business Expenses." These expenses can include vehicle costs, travel costs, work clothes and meals, but the IRS has stringent rules for documentation - taxpayers must "prove the time, place, business purpose, business relationship (for gifts), and amounts of these expenses," the instructions to the form explain. Employees with work expenses related to an impairment.Fee-basis state or local government officials.Additional Informationįor more information on work-related education expenses, education tax credits, or information for specific types of employees, such as performing artists, refer to Publication 970, Tax Benefits for Education and Publication 463, Travel, Gift, and Car Expenses.Only a few specific types of W-2 employees can still claim work expenses: Self-employed individuals include education expenses on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) or Schedule F (Form 1040), Profit or Loss From Farming.Īrmed Forces reservists, qualified performing artists and state or local government officials figure the cost of qualifying work-related education expenses on Schedule 1 (Form 1040), Additional Income and Adjustments to Income PDF and attach Form 2106, Employee Business Expenses to their return.ĭisabled individuals figure the expenses on Schedule A (Form 1040), Itemized Deductions and attach Form 2106 to their return. To determine if your work-related expenses are deductible, see Are My Work-Related Education Expenses Deductible? Reporting the Education Expense Other educational expenses, such as the cost of research and typing.Certain transportation and travel costs.

Tuition, books, supplies, lab fees, and similar items.Usually, absence from work for one year or less is considered temporary. After your temporary absence, you must return to the same general type of work. However, even if the education meets either of these tests, the education can't be part of a program that will qualify you for a new trade or business or that you need to meet the minimal educational requirements of your present trade or business.Įducation expenses incurred during temporary absence from your work may also be deductible, but the education must be to maintain or improve skills needed in your present work. To be deductible, your expenses must be for education that (1) maintains or improves skills needed in your present work or (2) your employer or the law requires to keep your present salary, status or job. A disabled individual with impairment-related education expenses.A fee-based state or local government official.You may be able to deduct the cost of work-related education expenses paid during the year if you're:

0 kommentar(er)

0 kommentar(er)